25 Percent Corporate Income Tax Rate? Details & Analysis

Taxation in the United States - Wikipedia

How do phaseouts of tax provisions affect taxpayers? Tax Policy

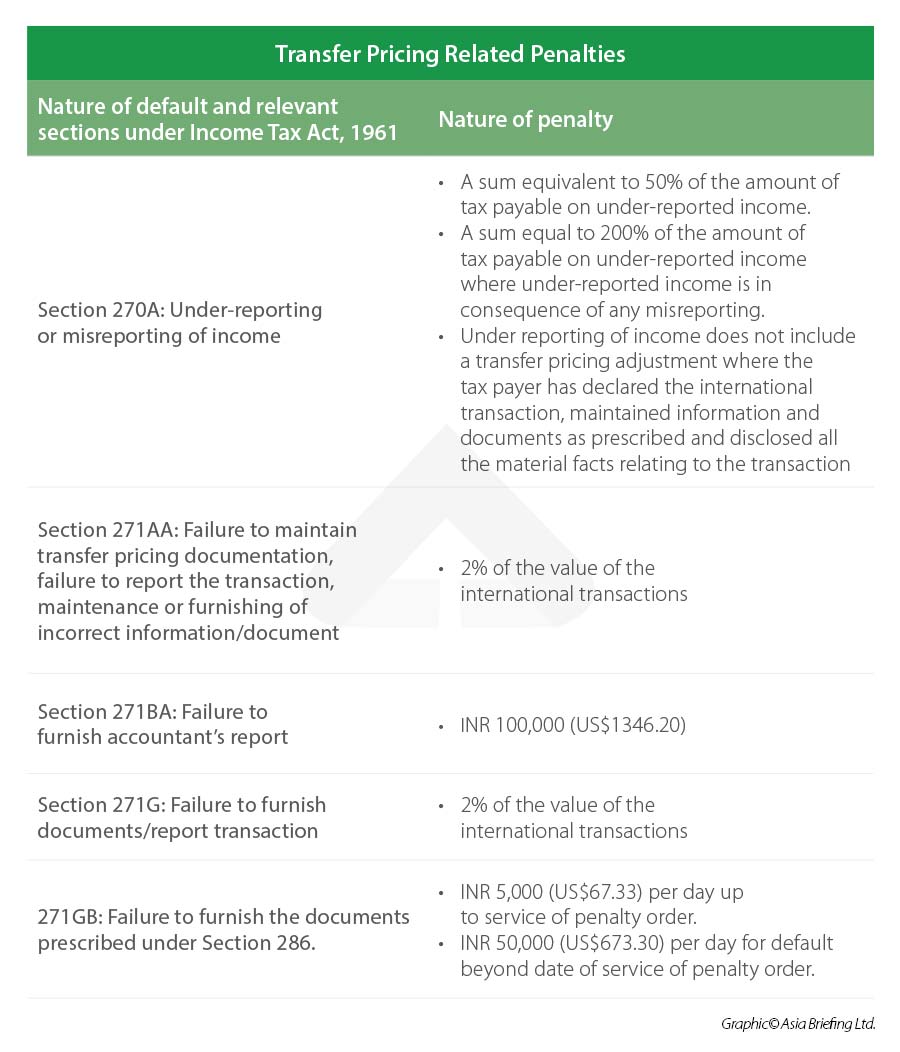

Transfer Pricing Methods in India and Utilizing Third-Party

Substantial Income of Wealthy Households Escapes Annual Taxation

e3962ex99-2.htm - Generated by SEC Publisher for SEC Filing

Understanding tax implications - FEMA and the Income-tax Act

No tax immunity from Black Money Act, Fema

IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More

WC Smith Tax Credit Apartment Communities WC Smith

KHO 2008 23 Finnish Dividend Taxation of EU

How did the Tax Cuts and Jobs Act change personal taxes? Tax

Tags:

archive