Exemption under section 11 of income tax act, 1961 income tax

Substantial Income of Wealthy Households Escapes Annual Taxation

Download Instructions for Form CT-651 Recovery Tax Credit PDF

Substantial Income of Wealthy Households Escapes Annual Taxation

GILTI regime guidance answers many questions

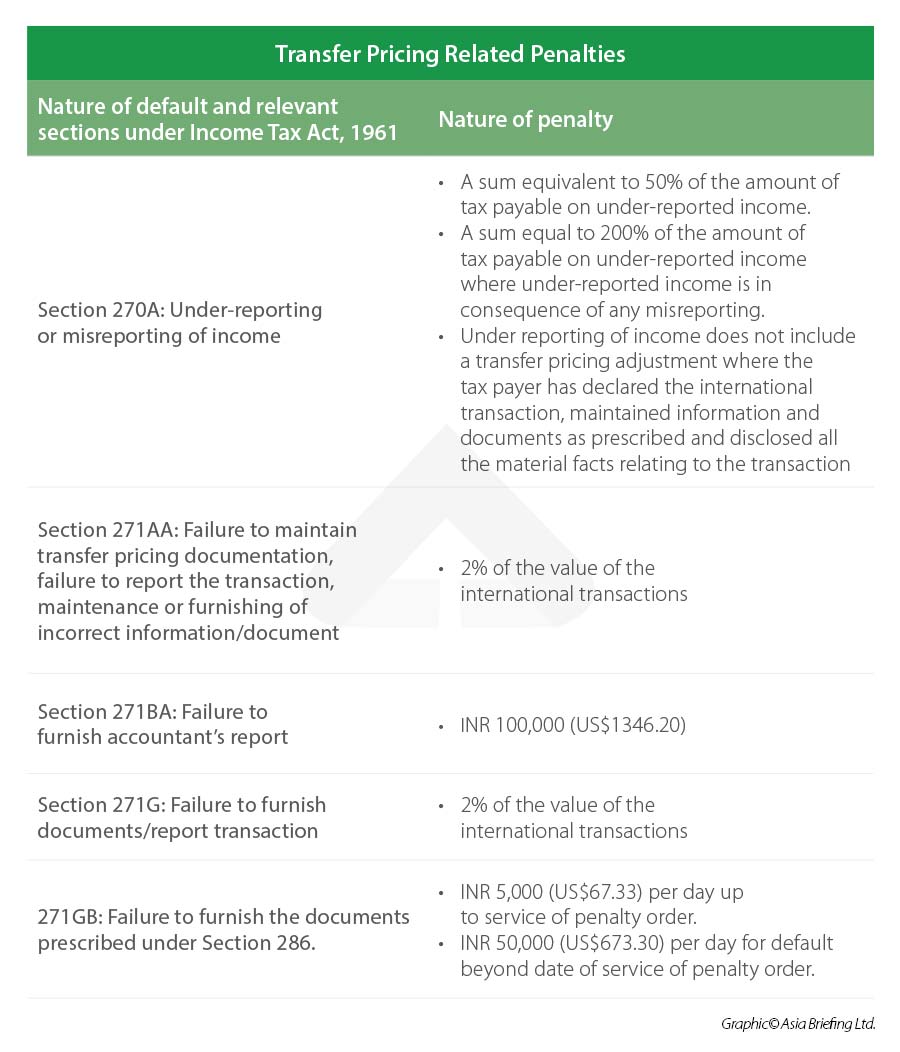

Transfer Pricing Methods in India and Utilizing Third-Party

Section 111A, 112A & 112 Under Income Tax Act Provisions SAG

GILTI regime guidance answers many questions

Welcome to Lawrency Update

2022 State Business Tax Climate Index Tax Foundation

How do phaseouts of tax provisions affect taxpayers? Tax Policy

Daily bulletin [2007 : March 21, v.2007 : no.33] - Daily Bulletin

Tags:

archive