GILTI regime guidance answers many questions

Section 44AB of Income Tax Act, 1961 Assisted By: CA Apoorva

Boston's Tax Rates Set for FY21 - Boston Municipal Research Bureau

Tax benefit: How to claim tax benefit on tuition fees under

Fillable Online Circular No.43 of 2016 F.No. 142/33/2016-TPL

FIRS Issues Information Circular On Bodies Eligible To Receive Tax

Finance Act 2017 Section 3 - Income tax bands - YouTube

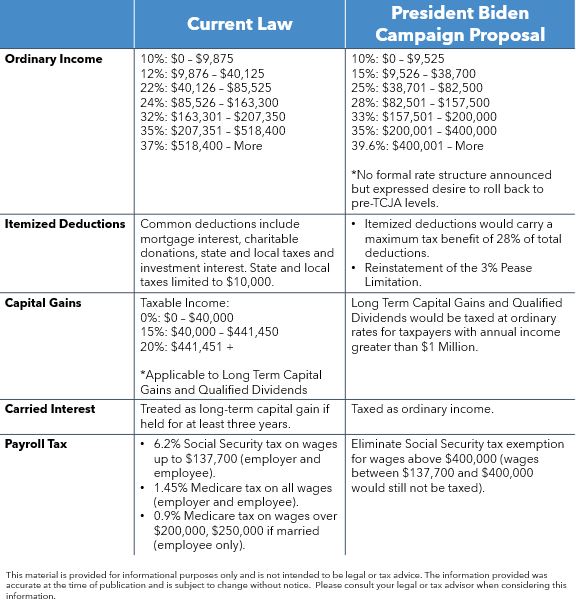

Scanning the Horizon in a Sea of Noise - Rockefeller Capital

the PU A 731982 or Income Tax Act 1967 Section 33 it stated that

CBDT Notification No. 91/2021 [F. No. 370142/33/2021-TPL] / SO ![CBDT Notification No. 91/2021 [F. No. 370142/33/2021-TPL] / SO](https://compliancecalendar.s3.ap-south-1.amazonaws.com/assets/commentdir/60b073fb84042dbe5e78987e02f559d3.jpg)

SUBJECT FIJI REVENUE & CUSTOMS AUTHORITY: if an asset is disposed

25 Percent Corporate Income Tax Rate? Details & Analysis

Tags:

archive